The medical insurance negotiation will start soon, and the domestic innovative drugs will compete with each other.

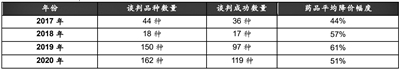

Comparison of Medical Insurance Negotiations from 2017 to 2020

Source: National Medical Insurance Bureau and Essence Securities Research Center.

After enterprise declaration, formal review and expert review, the national medical insurance drug list adjustment entered the negotiation stage in 2021. The reporter learned that the on-site negotiation of the medical insurance catalogue is about to begin.

Under the background of the rapid development of biotechnology and the accelerated rise of innovative drug industry in China, more domestic innovative drugs are accelerating to the medical insurance catalogue. According to institutional data, about 20 domestic innovative drugs will be negotiated for the first time, and the new indications that have been included in the varieties will be superimposed. In this round of medical insurance negotiations, investors have paid a lot of attention.

About 20 domestic innovative drugs were negotiated for the first time.

According to the previously published Work Plan for National Medical Insurance Drug List Adjustment in 2021 (referred to as the "Plan") and the medical insurance negotiation process in previous years, it is widely expected in the industry that this year’s medical insurance catalogue negotiation will start soon. The National Medical Insurance Bureau has previously made it clear that if the progress is smooth, this catalogue adjustment work will be completed before the end of this year, and efforts will be made to start implementation in January next year.

According to many brokerage research institutions, it is estimated that about 20 domestic innovative drugs will be negotiated for the first time this year, including PARP inhibitors, BTK inhibitors, ALK inhibitors, ADC drugs (antibody conjugated drugs), CAR-T therapy (chimeric antigen receptor T cell immunotherapy), etc., involving many listed pharmaceutical companies such as Beida Pharmaceutical, Baekje Shenzhou, Hengrui Pharma and Zejing Pharmaceutical. Among them, the CAR-T therapy, which is priced at 1.2 million yuan by Fosun Kate, has attracted much attention from the market. Some institutions pointed out that as a representative of expensive new technology, the negotiation result of this variety will closely affect the pricing of new technology products.

In addition, the anti-tumor drug PD-1 monoclonal antibody is still the focus. In the medical insurance negotiations in 2019 and 2020, the price reduction of PD-1 monoclonal antibody was remarkable. At present, the competition in the domestic PD-1 market is fierce. Ten PD-1/L1 have been approved for marketing, and new indications have been continuously approved, and the listing of new drugs has continued to accelerate. Ma Shuai, an analyst at Essence Securities, said that among the domestic varieties, the enterprises and varieties that are eligible to participate in the medical insurance negotiation in 2021 are still the four varieties that participated in the medical insurance negotiation last year, and the competition pattern of domestic varieties is relatively relaxed. It is expected that the PD-1/L1 monoclonal antibody will face fierce competition in the medical insurance negotiation in 2022.

Regarding the issue of price cuts that the public and investors are concerned about, Industrial Securities said that the current negotiation system for innovative medicine and medical insurance has gradually matured and improved, and it is expected that the future negotiation results will probably continue the overall price cuts in the past few rounds. Although the price reduction is not small, innovative drugs are successfully included in the negotiation list after the game of quantity and price, which will still bring incremental contributions to the corresponding varieties. Rapidly promoting R&D, seizing the first-Mover advantage and reasonable pricing strategy will become important factors in the market competition of innovative drugs.

Listed pharmaceutical companies are actively preparing for the war in order to increase the volume.

At present, many pharmaceutical companies are actively preparing for medical insurance negotiations. The third quarterly report disclosed by Baekje Shenzhou on November 5 shows that the company is preparing for the upcoming national medical insurance drug list negotiation for qualified products, including adding first-line treatment for non-squamous non-small cell lung cancer, first-line treatment for squamous non-small cell lung cancer and second-line or third-line treatment for hepatocellular carcinoma indications. On the 4th, Rongchang Bio disclosed the prospectus, saying that the company’s core products, Taitacip for the treatment of systemic lupus erythematosus and Videcituzumab for the treatment of gastric cancer, were approved for listing in China with conditions in March 2021 and June 2021 respectively, and the company is actively preparing relevant materials for participating in medical insurance negotiations, with a view to rapidly expanding the sales channels of products in a short time and effectively and rapidly promoting product sales. In the record of investor relations activities disclosed on the 2nd, Beida Pharmaceutical said that at the moment of a new round of medical insurance negotiations, the company is also actively docking the access of Kemena and Bemena.

Inclusion in the medical insurance catalogue has undoubtedly become an important catalyst for innovative drug volume. In July this year, the National Medical Insurance Bureau said in its reply to Recommendation No.9562 of the Fourth Session of the 13th National People’s Congress that after three years of continuous adjustment, a total of 233 drugs were successfully included in the medical insurance catalogue through negotiation, and the accessibility of patients to drugs was greatly improved, and the enterprise also reached the market sales expectation. Finally, the goal of "market for price" was realized. According to the data of Medicine Rubik’s Cube, a drug data platform, in 2017, 2018 and 2019, the sales of drugs that were included in the medical insurance catalogue through medical insurance negotiation increased by 128%, 337% and 39% respectively in 2020.

The Blue Book on the Progress and Effectiveness of Medical Insurance Drug Management Reform published by China Pharmaceutical Association and China Medical Insurance Research Association shows that among the 34 innovative drugs listed from 2016 to 2020, 26 drugs have entered the medical insurance catalogue, accounting for 76.5%. The time from listing to medical insurance for innovative drugs has also been greatly shortened. In 2017, it will take 4 to 9 years for new drugs to enter medical insurance, shortened to 1 to 8 years in 2019, and further compressed to 0.5 to 5 years in 2020.

Huachuang Securities believes that from the perspective of sales amount, except for some products with expired patents, most innovative drugs have achieved price-for-quantity exchange, and the amount has rapidly increased after entering medical insurance.

"Innovative drugs are expected to improve the difficulty of access after entering medical insurance, and achieve rapid penetration of hospitals and pharmacies." Ma Shuai analyzed that, on the one hand, after the drug enters medical insurance, it will be less difficult to obtain the recommendation application from clinicians, pass the preliminary selection of departments and finally pass the drug selection meeting in the hospital, which greatly reduces the difficulty of drug entering the hospital and lays a good foundation for the future drug in the hospital; On the other hand, in May this year, the National Medical Insurance Bureau and National Health Commission issued the Guiding Opinions on Establishing and Perfecting the "Dual-channel" Management Mechanism for National Medical Insurance Negotiation Drugs. After the drugs enter the medical insurance catalogue, it is expected that the "dual-channel" mechanism will accelerate the volume of products at the pharmacy side.