How big is the gap between the video number and Tik Tok?

After the vibrato burst into flames, the importance of the video number of WeChat in the interior also soared, asking for money, giving money and resources to resources. But up to today, there is still a big gap between the two: it is estimated that the gap between the video number and Tik Tok is between 3.3 times and 6.6 times. The second half of Touteng War will still be very exciting, please move the small bench ~

There is no doubt that video number, as a rising star, has already become one of the top three short video tracks in China after several years of catching up.

However, it is difficult for the industry to give a comprehensive and accurate data on how far the video number has developed and how far it is from Tik Tok.

The direct reason behind this is that WeChat is only a business group of Tencent, a listed company, and the video number is only a sub-product of WeChat, so there is no obligation to publicly disclose detailed data in the financial report. In addition, unlike independent apps, video is only a function of WeChat, which also makes it more difficult for third-party data monitoring.

Similarly, as the leader of short video industry, Tik Tok is also a non-listed company at present, so it is difficult for us to see the whole picture of Tik Tok data.

However, this does not mean that the video number and Tik Tok are completely two data black boxes. We can still make reasonable guesses from the limited public data at present, and then draw some meaningful conclusions-

In the business world, absolute data is important, while at other times, relative data is just as important or even more important.

Let’s take a look at two important absolute data of the video number-according to Tencent’s financial report and conference call, the advertising revenue of the video number Q2 in 2023 is 3 billion, and at the same time, the current advertising adsload of the video number is less than 3%.

Let’s look at some data from Tik Tok-

According to The Information, ByteDance’s Q2 revenue in 2023 was $29 billion, of which 20% came from overseas.

I think this data is relatively credible. On the one hand, The Information has disclosed the revenue of Byte many times before, including the revenue of Byte China of $69 billion last year, etc. These data are basically recognized and quoted by the industry.

On the other hand, if the data gap is large or untrue, bytes will jump out to refute or clarify. (For example, regarding the data of e-commerce GMV in 2022, bytes have been specifically denied. )

OK, based on the above data, we can actually make some relatively reasonable calculations-

Byte Q2 earned $29 billion, 20% of which came from overseas, that is, 80% came from China, and the domestic income was $23.2 billion.

Note: This $23.2 billion does not mean that it is all advertising revenue from Tik Tok. Only Tik Tok, a single product, also involves live broadcast revenue and e-commerce fee income (different from e-commerce advertising revenue).

In addition, Byte also has the income from a series of other businesses, such as today’s headlines, car owners, watermelon videos, tomato novels, flying books, games, Volcano Engine and so on. (You know, in 2017, when Tik Tok was just born, today’s headline income was as high as 15 billion)

So what is the proportion of advertising revenue in Tik Tok’s total domestic revenue?

This is a mysterious data, but fortunately, we also have some reference objects. Let’s take a look at the income composition of Aauto Quicker, a short video track listed company.

According to Aauto Quicker’s Q2 financial report this year, in Aauto Quicker’s income structure, advertising revenue accounts for 52.5%, live broadcast revenue accounts for 34.7%, and other income (including e-commerce) accounts for 12.6%;

Of course, we can’t directly use the proportion data of Aauto Quicker, because there is still a big difference between Tik Tok and Aauto Quicker.

Compared with Aauto Quicker, which started with the realization of live broadcast, Byte has been engaged in advertising business since 2013, and has formed a set of extremely strong tactics in advertising algorithm, product, operation and sales, so the proportion of natural advertising revenue will be higher. After all, live broadcast and e-commerce are the businesses that come later. (Although the fast-growing e-commerce GMV has surpassed Aauto Quicker)

I take Aauto Quicker as an example to illustrate that the revenue of Bytes is not all from advertising in Tik Tok. Compared with the early advertising revenue in ByteDance, which accounted for more than 90%, the proportion of advertising has dropped significantly now.

Therefore, when we estimate the advertising revenue, we need to make a discount. Considering the advantages of Byte in advertising and the existence of other huge business lines, we roughly give this discount a 60% discount.

At this time, we can calculate the income of Tik Tok’s advertising business-29 billion * 80% * 60% = 13.9 billion US dollars, or 99.5 billion RMB.

The reason why we have to calculate the advertising revenue of Tik Tok is because we have to compare it horizontally with the advertising revenue of the video number in the same period-

The revenue of video number Q2 this year is 3 billion, and the estimated revenue of Tik Tok Q2 advertising this year is 99.5 billion, which is 33 times.

Does this mean that the gap between video number and Tik Tok in user data is 33 times?

Of course not. We also have to consider two factors: the advertisement loading rate Adsload and the advertisement unit price ECPM.

Obviously, there are many advertisements in Tik Tok, but there are few advertisements for video numbers. According to the data disclosed by Tencent at present, the adsload of video numbers is less than 3%.

So, what is the advertising Adsload in Tik Tok?

This is also a mysterious data.

But we can still reasonably guess—

James Mitchell, chief strategy officer of Tencent, said: the competitor’s adsload exceeds 10%, and this competitor naturally includes Tik Tok;

According to a research report of Huachuang Securities, Tik Tok’s Adsload in 2019 has exceeded 12%;

In addition, according to the daily sense of body, it is very common for Tik Tok to insert five videos into one advertisement, which does not include the content-heated advertising product of Dou+ without advertising logo, and it is already 20% for five videos to insert one advertisement.

In fact, the advertisement Adsload of a product itself is not static, and it will be dynamically adjusted according to many factors such as supply and demand, time nodes and so on.

Based on the above data and some three-party calculations in the industry, we take Tik Tok’s Adsload as 15%;

At this time, we can work out the difference of the service volume of the video number on the user side, that is, the volume relationship between them needs to be divided by the multiple of their Adsload on the basis of the revenue multiple, that is, the above 33 times need to be divided by 5, which equals 6.6 times, that is, the current broadcast volume of the video number has a greater probability of being 6.6 times that of Tik Tok.

Of course, strictly speaking, this caliber is not entirely the amount of play, which can be roughly understood as the number of times the video information stream is refreshed, that is, the space for inserting advertisements.

Compared with the fuzzy process indicators such as daily activity, duration and duration of a single video, the total broadcast volume directly calculated above is obviously more meaningful. After all, the process indicators ultimately serve the result indicators.

It must be noted that our calculation is still rough, because there is a hidden assumption-the advertising unit price ECPM of video number and Tik Tok is the same;

This assumption and premise itself also have enough room for discussion-

In essence, ECPM reflects the efficiency of advertising.

In fact, the competition between Byte’s huge engine and Tencent’s advertisement in the whole advertising market is an extremely wonderful comprehensive combat of China Internet.

In the past few years, the two have competed in technology, products, operation, market, sales and ecology, and the two sides have come back and forth in the constant game;

Objectively speaking, after a long-term struggle, Tencent’s technical level, professionalism and comprehensive strength have reached the level of the first echelon in the Internet advertising industry, not only at home but also at the international level.

Of course, the overall efficiency of Byte advertising system is one of the best at present because of its relative advantages in algorithm and crowd level objectively. Many advertising agencies told me that in most cases, the ECPM of effect advertising Tik Tok is indeed higher than other advertising platforms.

I heard an unconfirmed data in the industry is that the advertising ECPM in Tik Tok is twice as high as that in Aauto Quicker. (Again, this data is unconfirmed)

I have every reason to believe that Tencent’s advertising, which has been deeply rooted in efficiency for a long time, will not have a gap of twice as large as that of Tik Tok. If we take twice as the lower limit, the ECPM of the two will be equal and twice.

Then according to the above calculation, the most important conclusion of this paper comes-The difference between the video number and Tik Tok is estimated to be between 3.3 times and 6.6 times.

OK, so the question is coming-how about the video number?

In my opinion, this is undoubtedly an excellent performance.

You know, according to Tencent’s latest financial report, the number of Q3 video numbers has surged by 50% this year, while the total duration of Q2 video numbers has nearly doubled this year.

That is to say, the video number is still growing at a high speed, which means that the gap of 3.3-6.6 times will continue to narrow in the context of the objective slowdown of Tik Tok’s growth momentum.

As a late-developing product, as the only remaining fruit after Tencent’s various short video products held high and played high, and as the "hope of the whole village", the video number achieved this order of magnitude in less than four years under the difficult background that the industry generally believed that the pattern had been set, and abruptly completed the task of playing the short video table.

Zhang Xiaolong and his WeChat team once again proved their strong strength as a latecomer, and the depth of Tencent’s bench was also vividly displayed in this campaign.

Going to the table doesn’t mean you can sit back and relax. Sustainable growth is the eternal theme of this infinite game. How will the video number cope with the competition at the table?

I noticed that in the conference call of Tencent Q3, Tencent talked about the following four logics when explaining the future potential of video number-

- Growth of traffic:This means that the data on the user side is still growing. According to the financial report, the total duration of Q2 video number nearly doubled year-on-year, and the number of Q3 plays increased by 50% year-on-year.

- Promotion of advertising Adsload;This means that the current Adsload of video number is indeed lower than that of competitors;

- The increase of click-through rate of AI-blessed advertisements;This means that the big model is used in advertising algorithms. For example, Tencent’s mixed-element big model was originally built for advertising.

- Closed-loop opportunities:This refers to the internal circulation growth space including enterprise WeChat, applet, payment and e-commerce.

From a logical point of view, there is nothing wrong with these four angles, but what I want to say is that there is actually a big logic in the opposite direction behind these four small logics, that is, the overall scale of Internet advertising-

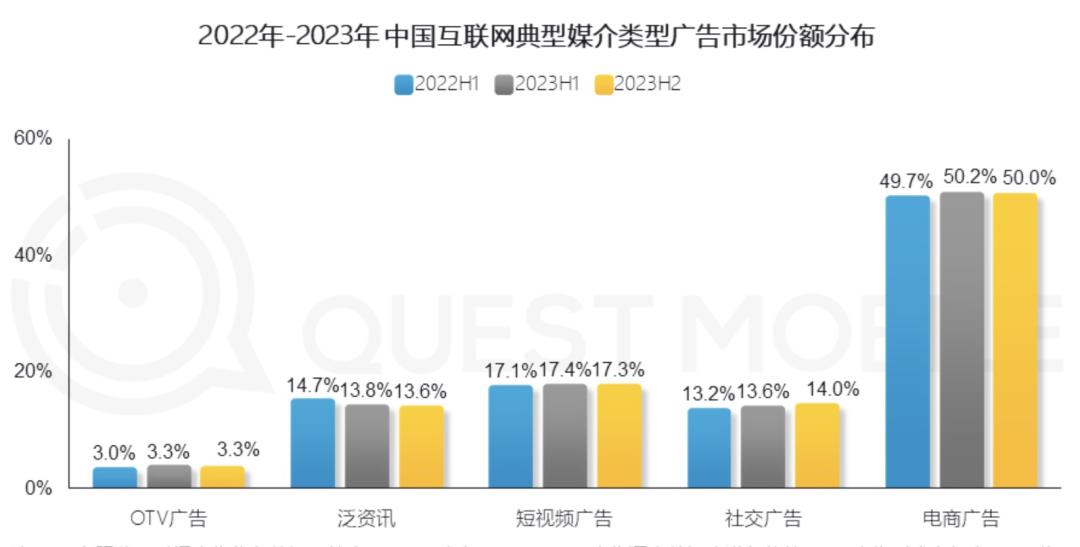

According to Questmobile’s data, the total scale of domestic Internet advertising market will increase by 4% in 2022, and only by 2.3% in Q1 2023.

In view of the current economic situation, the Internet advertising market has objectively bid farewell to high-speed growth, and will enter the new normal of micro-growth.

At the same time, the substitution effect of short video advertisements preempting other types of advertisements is also disappearing. According to Questmobile’s data, the market share of short video advertisements has stabilized in the past year.

Under this premise, the increase of user-side growth, Adsload, click-through rate and closed loop mentioned by Tencent will certainly increase advertising revenue, but the increase of total supply and the constant total demand mean that this increase ratio will be discounted.

Simply put, your advertising volume will increase by 50%, and your advertising revenue will inevitably not increase by 50%, which is an important supplementary factor that restricts the imagination of video number revenue.

Indeed, personal struggle is very important, but we must also take into account the historical process.

Therefore, for the video number, the internal circulation revenue it emphasizes becomes quite important. The strong rise of e-commerce in Tik Tok and the simultaneous surge of advertising revenue fully prove the strategic significance of internal circulation.

In essence, the core of doing closed-loop e-commerce lies in two points-

The first is that the complete data link based on transaction brings efficiency improvement, that is, its advertisement is more accurate, and it knows what characteristics those people who place orders have;

Second, the extension of the value chain, including performance, makes it possible for the platform to collect taxes, and merchants are willing to contribute fees to the closed loop.

Obviously, Tencent is also greedy for the business increment brought by the closed loop. A new formulation of this financial report is "Pan-internal circulation advertising revenue linking WeChat applets, video numbers, WeChat official account and corporate WeChat landing pages", which increased by 30% year-on-year.

However, this is a difficult challenge for the video number, which is genetic in a sense-

The WeChat team is famous for its elitism within Tencent, and its prominent feature is its high human efficiency. It has been committed to doing things with fewer and more efficient people. For example, the team members of WeChat Pay are much smaller than Alipay in scale.

One of the drawbacks of elitism and focusing on human efficiency is that the WeChat team has not done dirty work.

In the past, the typical style of play was that Zhang Xiaolong launched a small team, made hard efforts and thought clearly from the top-level architecture and product mechanism, and used the super base of social interaction to pry a business sector, such as WeChat payment, applet and video number.

However, the internal circulation like e-commerce is very heavy, its chain is very long, there are many aspects of performance, the cost is extremely high, and the information flow, logistics and capital flow are intertwined and complicated, so it is difficult to solve the battle only by relying on the top-level design at the product level or the strategic level.

In a word, the video number is doing dirty work such as e-commerce and local life, and the long-term product leverage of the WeChat team will be discounted.

To get rid of this hard bone, WeChat must really sink, take the initiative to do some hard work that it didn’t want to do before, and change the tactics of promoting business based on products and strategies that have always been advantageous in the past.

So, does WeChat have this level of consideration?

The answer is that there is no very clear signal yet.

Why do you say that?

Let’s cut in from a small perspective. As an industry observer, I have a small habit when studying Tencent, that is, I go to its recruitment website to see the latest recruitment positions of various business departments. The types and quantity of these positions reflect the work focus and tendency of the business group to a certain extent from a unique angle.

I have seen 51 non-technical posts related to business in the posts recently released by WeChat business group, among which 13 are related to video numbers, which are not too many. There are many posts such as "senior strategic product manager for live broadcast with video numbers" and "senior product manager for business operation of small shops with video numbers".

It can be seen that, at least from the perspective of recruitment, the video number team has no idea of focusing on the business for the time being, and still plans to continue to promote the business through its product strategy advantages.

However, my view is different from that of the industry. I think Zhang Xiaolong is by no means a product defender who sticks to some so-called obsession.

On the contrary, his figure is quite soft, facing the business reality and being thoroughly remoulded at the business level many times-

From Foxmail to QQ mailbox, it is a change from software thinking to internet thinking, from QQ mailbox to WeChat is a change from PC thinking to mobile genes, and from the minimalist rule in the early days of WeChat to the hug algorithm now is a change in product logic.

Any one of these changes is actually a "sudden change" level, but each turn is quite silky.

Therefore, in this sense, as long as it is really necessary in business judgment, it is not an unexpected thing for WeChat and video number to change their long-standing strategies and focus on business in the next short video amount competition.

At the same time, we should also see that WeChat has its own advantages objectively.

This advantage lies in the fact that it has a set of interwoven components established by WeChat official account, applet and enterprise WeChat, which has been imperceptibly embedded in various business links of many advertisers to some extent.

This kind of embedding has a moat effect, and the migration cost is very high. For example, an education company uses enterprise WeChat as its private domain, so the link in WeChat must be the smoothest in the advertising process, which has become an important advantage of video number advertising.

In the future, VideoNo. and Tik Tok will definitely meet each other in heavier businesses such as e-commerce and local life, and the victory or defeat of the battle depends on their traffic utilization efficiency.

Tik Tok has always been data-rational, and the distribution of traffic depends on the cold ROI. Behind the inclination of traffic to e-commerce, the profit-making efficiency of e-commerce is indeed high. Tik Tok has also poured a lot of traffic into games and hardware Pico, but it turns out that the ROI of the latter two is not ideal, so it is cut off cleanly.

The traffic of the video number is the same logic. Today, the landing page is a relatively large proportion of enterprise WeChat and small programs, and if the ROI of e-commerce and local life continues to improve, it will inevitably get a traffic share that matches its efficiency.

The distribution and center of gravity of video number in the future will determine its commercial competitiveness, and it will also be an important point of competition between video number and Tik Tok in the future.

At this time today, the competition in the short video market has already entered the deep water area, and the competition on the track has become an incomparably real mixed fighting, which is worse than physique, skill, endurance and logistics, and at the same time, it has fewer mistakes than anyone.

In the short video business, the user’s migration cost is actually not as big as expected. In the end, it is based on the long-term retention and realization of content ecology and user habits.

In this sense, how far the video number can go on the short video track, what kind of ceiling it can reach, and how to differentiate itself from Tik Tok and Aauto Quicker are still the most anticipated challenges for China Internet in the next few years.

Under the background that the Internet in China has changed hands, the second half of Touteng War will still be extremely exciting. Please move the small bench ~