From leading to being surpassed, where should Gree Electric, the elder brother of the old household appliances go?

Stock trading depends on Jin Qilin analyst research report, which is authoritative, professional, timely and comprehensive, and helps you tap the potential theme opportunities!

Produced by: Sina Finance Research Institute of Listed Companies

Author: ZZX

In April 2018, Dong Mingzhu mentioned in an interview.Shi Zeng responded domineering: "He (referring to Midea Group) is not an opponent at all. If I regard him as my opponent, I feel very sad." "I am the world’s boss in the field of air conditioning. Who is he?"

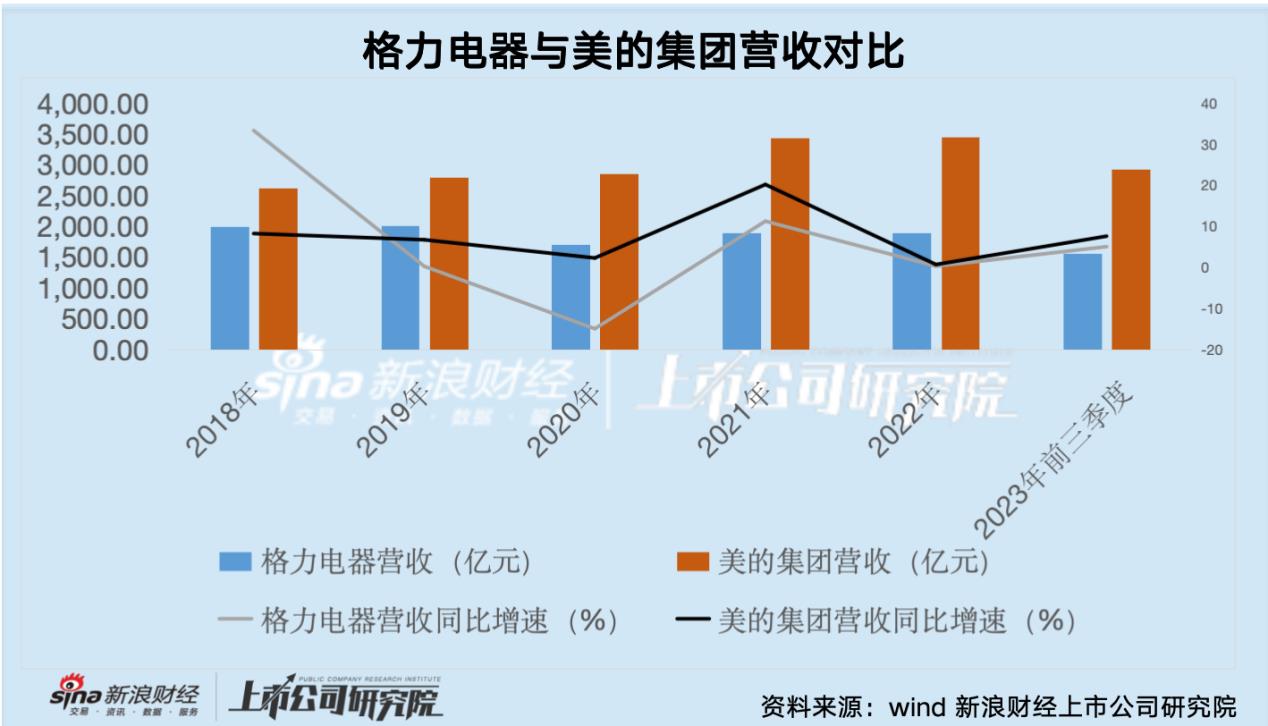

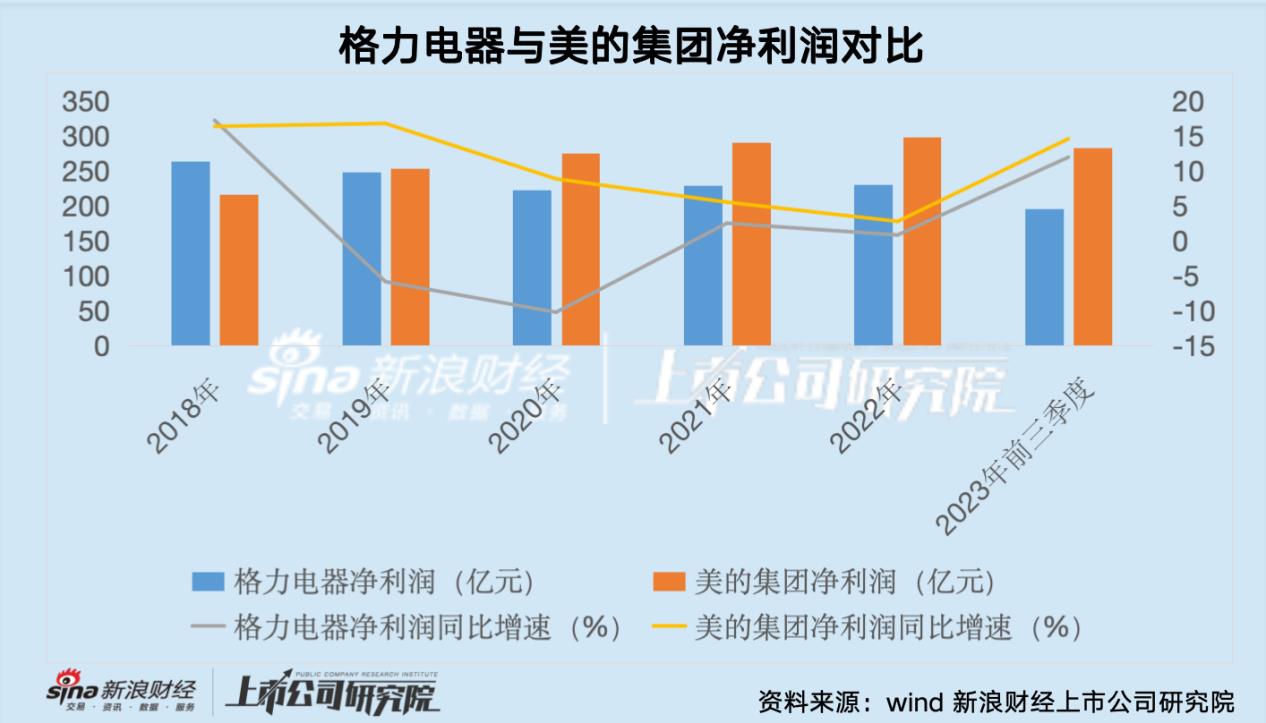

However, in just a few years,From "despising beauty" to "not catching up with beauty". According to the report of the first three quarters of 2023, Midea Group achieved sales of 292.38 billion yuan in the first three quarters, while the sales of Gree Electric in the same period was only 155.8 billion yuan, and the revenue of Midea Group exceeded that of Gree Electric by 136.58 billion yuan. From the perspective of profit, Gree Electric’s net profit opened a gap with Midea Group after 2019.

Then, why did Gree Electric fall far behind Midea Group in terms of revenue scale and net profit scale in just a few years? Is there a problem with Gree Electric’s corporate strategy and internal management?

Many strategic misjudgments have widened the gap between Gree Electric and Midea Group’s revenue and net profit.

By comparing the revenue scales of Gree Electric and Midea Group in recent years, we can also see that 2019 is a watershed between them. From the perspective of revenue, the revenue growth rate of Midea Group surpassed that of Gree Electric in 2019, and continues to increase. In addition to the HVAC business, the rapid growth of Midea Group’s revenue is mainly based on the rapid recovery of its small household appliances business after the epidemic.

From the perspective of net profit, Gree Electric’s net profit growth rate has been surpassed by Midea Group since 2018, and the net profit has been surpassed by Midea Group in 2019, and the gap has widened after the epidemic.

Gree Electric’s recovery after the epidemic is relatively weak. In terms of total revenue, the total revenue from January to September 2023 was basically the same as that in 2019 before the epidemic, but the net profit was not as good as that in 2019.

Going deep into the income statement, the sales expenses and management expenses of Gree Electric in the first three quarters of 2023 were 13.28 billion and 4.78 billion respectively, up by about 59% and 20% year-on-year.

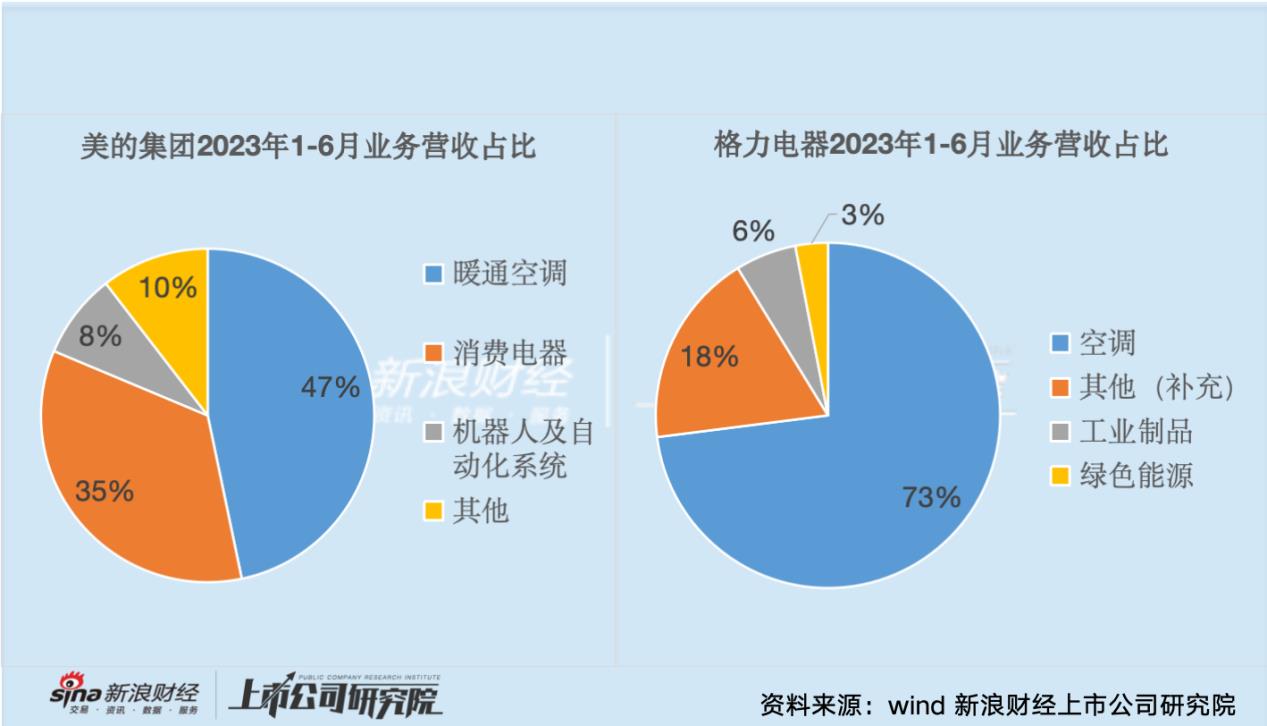

Gree Electric mentioned in the company’s semi-annual report in 2023 that the reason for the increase in sales expenses was "the increase in product installation and maintenance fees". The author thinks that the cost increase is mainly due to the over-concentration of Gree Electric’s main business, and the air-conditioning industry accounts for about 70% of the company’s main business for a long time, lacking product diversity. Compared with Gree Electric, Midea Group’s business is obviously more diversified. In recent years, Midea Group’s continuous efforts in consumer electronics business have made the company’s revenue resilient and wide-ranging.

By analyzing the company’s strategy, the author thinks that the following three events may make Gree Electric be surpassed by Midea Group during the epidemic period and continue to widen the distance.

First, in 2012, Zhu Jianghong retired, Dong Mingzhu took over from Gree Electric, while He Xiangjian, the founder of Midea Group, retired and Fang Hongbo (Jin Qilin analyst) took over. The two sides chose different strategic paths at this critical moment. Midea group actively embraced the second curve and increased investment in new product research and development; Gree Electric, on the other hand, under the leadership of Dong Mingzhu, focused on the main business of air conditioning, and his business diversification was a little late.

Secondly, Midea Group complied with the trend of China’s business transformation, from scale economy to quality economy, and implemented supply-side reform and "efficiency-driven" strategy. Through the reconstruction of T+3 mode, agile operation and flexible manufacturing can be realized. Gree Electric, on the other hand, insists on the traditional mode of "pressing goods, rebate and fixing sales by production", which leads to rising costs and declining efficiency.

Finally, in the face of the rise of e-commerce, Midea actively implements the "two-wheel drive" strategy, which not only improves the efficiency of traditional channels, but also innovates the marketing model to conform to the development of e-commerce. However, Gree Electric’s e-commerce channel was slow and relatively negative in the early stage, which led to the online market share being surpassed by Midea Group.

It is noteworthy that Gree Electric entered the smart phone market in 2015. In 2017, on the first generation of Gree mobile phones, Dong Mingzhu, the chairman of Gree Electric, put his head on the boot screen of the mobile phone, and every time the user turned on the phone, he could see Dong Mingzhu’s photo with greetings from Dong Mingzhu below.

Although Gree Electric has never published its mobile phone sales, according to the sales data of several e-commerce platforms, the total sales volume of Gree mobile phones since its establishment in 2015 is about 40,000-50,000 units. In contrast, in 2023 alone, the total shipments of mobile phones in the domestic market totaled 289 million units.

In the smart phone market with many high-tech companies, such as Xiaomi Company, which focuses on cost performance, and Huawei Apple, which focuses on high-end, Gree Electric’s failure in the mobile phone market may have become inevitable.

The crumbling air-conditioning business in the post-cycle era of real estate

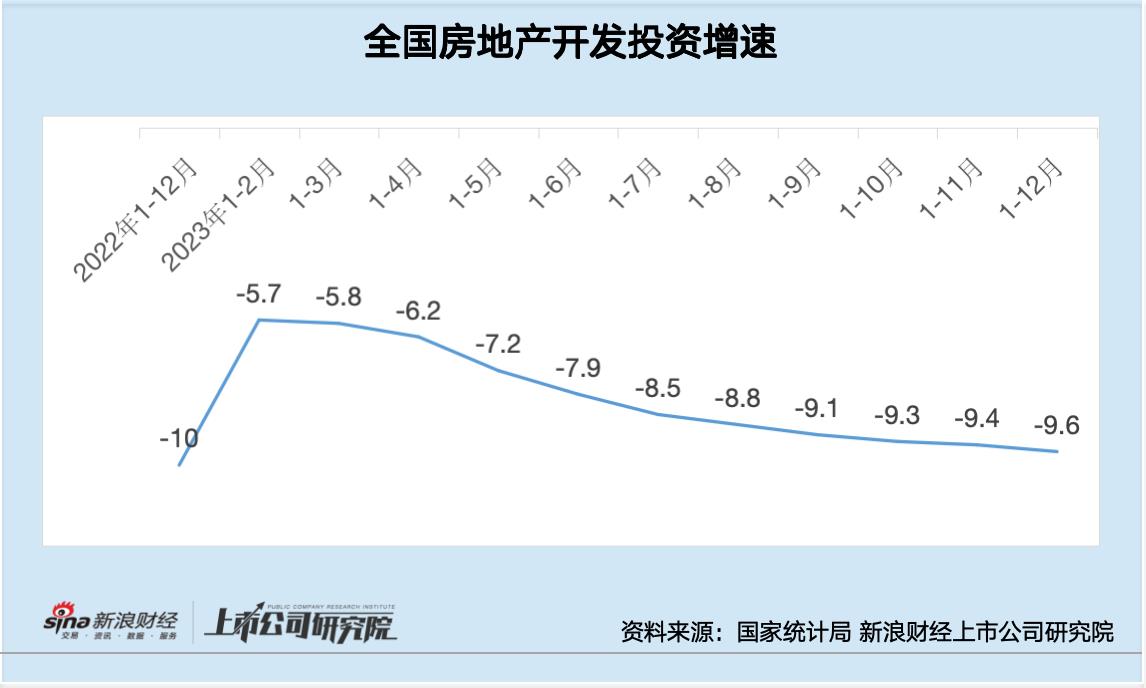

Lack of significant second growth curve support, business is concentrated in air-conditioning business in Gree Electric. At the bottom of the post-cycle of real estate, whether the company’s revenue can maintain the status quo may also be debatable.

As a daily electrical appliance purchased by every household, air conditioning benefited from the vigorous development of China’s real estate market in the past, and also ushered in its own prosperity. A number of studies show that, although there is a certain lag, there is a high correlation between the sales volume of air conditioners and the number of new houses delivered.

According to the data of the National Bureau of Statistics, in 2023, the national real estate development investment was 11,091.3 billion yuan, down 9.6% from the previous year; Among them, residential investment was 8,382 billion yuan, down 9.3%. From the real estate market pain caused by aging and economic transformation, the author will put a question mark on the sustainable growth of Gree Electric’s revenue.