Floating profits and adding positions is the taboo of futures investment —— Interview with "Datian Aaron", the king of the market

First, wonderful views

1. Cognition of varieties is the core factor of making money.

2. In investment transactions, we are not so much trading our own ideas as human nature.

3. Choosing a stop loss doesn’t mean completely giving up trading on that variety, but waiting patiently for the next better trading opportunity. This is my secret.

4. Risk control is always the focus in the transaction process, and controlling capital risk is always on the road.

5. Any variety will have a ceiling of price and a cost line.

6. When stopping loss, we should not only look at the range of market fluctuation, but also pay attention to the market sentiment.

7. Adding positions after floating profits is a big taboo in futures investment.

8. Wealth is the realization of cognition, and futures investment is actually the money to earn personal cognition.

9. Traders must make friends with data, establish their own database, and focus on inventory through the database.

10. The withdrawal of funds is a process that investors will inevitably experience in their growth, and it is an inevitable price to pay.

11. Futures trading is the human nature of investors, so the result of futures trading is actually the embodiment of human nature.. Only by constantly training and improving themselves can investors become more and more mature.

12. Positions reflect investors’ greed and fear of the market. When you are greedy enough, you will often add a lot of positions, and many mistakes will occur during this period.

Second, the introduction of Pan Wang

"Datian Aaron", a contestant in the National Futures Firm Competition of Big Handnet, was born in 1982, and is now 39 years old, from Shanghai.

After graduating from college, I worked as a project manager in an IT company in Shanghai. After resigning in 2014, I started to invest full-time, and I started to do futures in 2017. Amateurs like playing football. Good at trading based on fundamentals, expert in futures investment.

Third, performance analysis

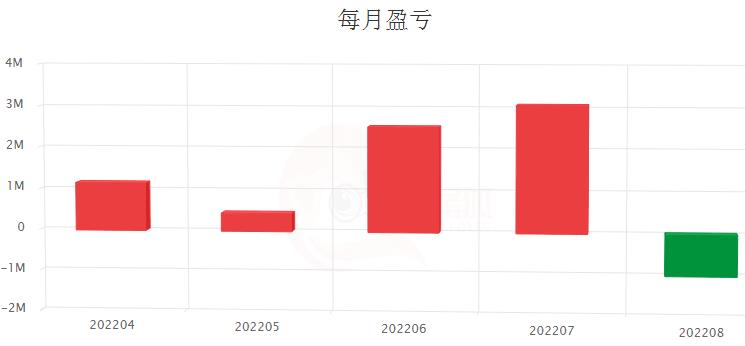

As of August 16, 2022,Pan Wang’s accumulated net profit in Xiaotian Aaron, an entry account of Dapan Handnet, was more than 20.51 million yuan, accumulated profit was more than 22.79 million yuan, Sharp ratio was 2.72, and accumulated yield was 62.17%.

Pan Wang’s current entry account is "Datian Aaron". Since April 21, 2022, within 80 days of trading, the cumulative yield is 84.97%, the cumulative net profit is 5.19 million yuan, and the maximum withdrawal is 38.26%.

The transaction analysis artifact of "Seven-tailed Fox" in the large-scale mobile network analyzes the entry account of Pan Wang as follows:

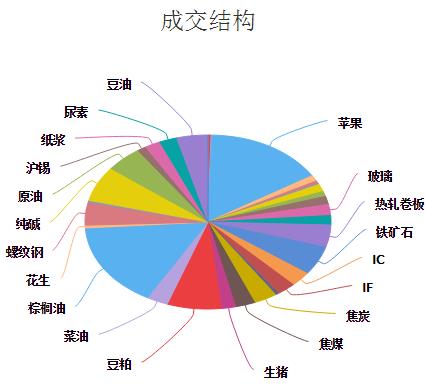

Pan Wang is almost a full-variety transaction.It belongs to the style type of partial intraday trading based on fundamentals.

Panwang trades more in apples, palm oil and other varieties, accounting for nearly 25% of the positions. On April 29, 2022, the highest position reached 94.81%, and the lowest position rate was 48.61% on May 9.

Panwang’s profits in iron ore, apples, palm oil and thread all exceed 1 million yuan.It is profitable in black varieties such as coking coal and hot coil.

Fourth, the interview record

01

IT paves the way and lays a good foundation for your career

I have been doing futures for about 4 to 5 years. Before that, I was doing stocks. I participated in the futures competition of the big hand net for about two years. My previous account was "Xiaotian Aaron", but now I have changed my account to "Datian Aaron".

Before professional investment, I worked in an IT company. At that time, my main job was to manage projects.

From a professional point of view, my previous work experience did not help me much in my later investment work, mainly because my attributes were completely different and had no relevance, but it was actually helpful in a deeper level.

When managing the project, I considered it more and comprehensively, which laid a foundation for the cultivation of trading personality characteristics such as logical thinking, endurance, execution, endurance and mentality required by my later investment work.It is helpful in this respect.

02

At the beginning of the investment, there was a stumbling block to retreat.

When I started my amateur investment, I was always doing stocks.

In 2017, I began to contact futures, among which there was a leader. With his guidance and help, I slowly began to learn to do futures and have a better understanding of how to make good investments. Therefore, compared with ordinary futures investors, I may have taken fewer detours, which is a very lucky thing.

I have always used subjective trading based on fundamentals in futures, and I have never been exposed to programming.

In the early days of full-time futures trading, the biggest difficulty I encountered was the relatively large withdrawal of account funds.

The fund management method of investing in stocks is different from that of futures. When investing in stocks, it is basically Man Cang. Now it seems that compared with futures, the fluctuation of stocks is actually relatively small.

When I started to do futures, I had no experience in fund management, and my position was always heavy, so I often encountered a relatively large withdrawal of funds. Especially in the first two or three years, the withdrawal of funds was relatively large, almost more than 50% every year.

During that time, I always lost, won, rose and fell, and my account was often a roller coaster, and I didn’t do well.

It was not until the last two years that I slowly controlled the retreat, broke through the bottleneck and embarked on the road of steady profit.

To solve this biggest difficulty at the beginning, I mainly adopted the following methods:

First, strengthen research and strive to make it thorough.When I first started to do futures, I was actually an out-and-out novice. I didn’t know anything about varieties, almost completely, so I paid a lot of tuition for the first two years.

But in the past two years, with the gradual deepening of research work, I have become more and more familiar with the fundamentals of the varieties I trade, so I have become more and more confident.

The second is to control your own trading frequency.

If you are in full bloom, butterflies will come; If you are well, it will be sunny.

It is because I am more and more familiar with it that I make fewer and fewer mistakes when placing orders.

Therefore,Doing research well is the basis of fundamental traders.

The third is to strengthen fund management. The amount of money I invested in a single variety has gradually shrunk.There was no concept of fund management at the beginning, and now my position in a single variety is basically not higher than 30%, usually about 10% to 20%.

These changes made me control the retreat.

03

Strong knowledge of successful trading control risk

I think: the core of trading is to thoroughly understand the fundamentals, because we are not programmed trading, and we rely on the degree of cognition of a certain variety when trading.

In the past, my commodity futures trading was mainly apple, and then it gradually developed into other varieties. In fact, the methods are the same, and all transactions are based on their own research and understanding of varieties, in other words, cognition.Good cognition is the core factor of making money.

I am a subjective investor who focuses on fundamental trading. At the beginning of investment, I had both experience and lessons in variety selection, opening and closing positions, stop loss and take profit.

When I started trading futures full-time in 2017, the variety that traded more was Apple. Mainly because in 2017, Apple suffered a serious "cold spring", which led to a sharp rise in prices in 2018.

It was based on this fundamental factor that I chose to trade Apple at that time and earned my first bucket of gold in investing in futures.

Investors are essentially trading their own cognition and personality, and they also need luck.

"Success is Xiao He, and failure is me". After making money on trading apples, on the one hand, I managed my position badly; On the other hand, due to my lack of trading experience, I soon returned most of my profits to the market.

At that time, I didn’t have any knowledge about where the price of Apple might go up. I naively thought that it could go up all the time, and then I encountered a big retreat.

Therefore, the first trading experience of Apple had both the joy of success and the frustration of failure, but in any case, it brought me valuable experience through that trading process.

Since then, when I choose a certain trading product, I usually base it on whether I understand it or not. Only in this way will I start investing. Whether it is apple or other varieties later, I will open the warehouse only after I have studied it clearly.

Although the research before the transaction was well prepared and considered to be very certain, I would choose to stop if the fact that it showed in the market at that time made me lose money or was different from what I expected.

Now, I am very disgusted with making the loss bigger, which is absolutely unacceptable to me. It is normal to admit mistakes.

Choosing a stop loss doesn’t mean giving up trading on that variety completely, but waiting patiently for the next better and more certain trading opportunity. This is my secret.

My trading system, in fact, is not much technical. You can keep the list of making money; For the list of losing money, the stop loss will be firm. For example, if the capital loses 10% or 15%, then we will unconditionally cut positions.

Risk control is always the key point in the transaction process, and controlling the risk of funds is always on the road.

04

Take profit and stop loss, carefully judge the market.

The profit-taking method I adopted in the transaction is mainly based on the following aspects:

One is based on the understanding and familiarity of varieties.

For a variety like apple, first of all, 5 yuan a catty is a very high price; Secondly, it has a fixed fee brought by the delivery rules. For example, when the market price of crude oil exceeds $120, the general duration will not be too long.

Unfortunately, in 2018, I didn’t understand this at all.

Any variety will have a ceiling of price up (or high price will curb consumption) and a cost line down, which are two very important trading factors.

The second is based on the understanding of the historical price of a variety.If the market price of a certain variety reaches or approaches a historical high and the price deviates seriously, then we should also choose to take profit;

The third is based on the judgment of fundamentals.If the fundamentals of the market change, we will also take profit.

Since we buy with reference to fundamental factors before trading, we must track the fundamental changes in the market every day. When there is a fundamental change in fundamentals, then we will also take profit and leave.

There are similarities and differences between fundamental trading and technical trading.As long as the conditions change, then the transaction must change.In technical trading, we often buy and sell according to the situation of big yin or big yang; If you use fundamental trading, this is probably the same reason.

When stopping losses, we should not only pay attention to our own stop loss points, but also pay attention to the market sentiment.In trading, sometimes you can obviously feel that the market sentiment is not quite right or not quite what you imagined. If this happens, you can stop the loss earlier.

Sometimes, if you think it is possible that the market has made a temporary mistake, then the stop loss range can be slightly enlarged. Of course, this should be judged according to your own experience and trading feeling, provided that you have a thorough study of the fundamentals before you can enlarge or narrow the stop loss range.

As a trader, it is necessary to accumulate knowledge of fundamentals and trading ability. Otherwise, it is just a waste of time to do it year after year, and I have not grown up.

05

A big taboo for floating profit and jiacang futures investment

When I first made futures, I had a bad habit, that is, I liked to add positions after floating profits. Because your risk awareness is not strong enough, if you often add positions after floating profits, then a small fluctuation will destroy the profits you have accumulated for a long time.

I think:Adding positions after floating profits is a big taboo for futures investment.

On the one hand, when you plan the number of open positions, you should try to abide by it and not change it.

Now I have achieved that I will not add positions after floating profits, which also avoids the differentiation of mentality caused by fluctuations.

Fundamentals sometimes do lag. For example, when the market price of a variety fluctuates greatly, we sometimes have no way to know what happened in the first place. At this point, I will make some changes according to the market, so there will inevitably be some intraday trading.

When I feel that the trend is not quite right, or when the disk gives me a bad feeling, I will do some transactions, sometimes this is a helpless move to deal with risks.

Therefore, taking profit and stopping loss does not mean that the price must fall on the set ceiling or floor. When there are some fluctuations beyond your cognition in the market, you should also be vigilant. This is an experience.

Some programmed investors, they think that floating profits and adding positions is a better method, which has something to do with their trading types. While they are making floating profits and adding positions, I believe that they will inevitably match the corresponding stop loss bars, and the transactions are all matched.

We can’t just see the beginning of their transaction and not the end of their transaction.Any kind of transaction, whether fundamental or procedural, has a head-to-tail match.

We can’t "blind the eyes with one leaf, but we can’t see Mount Tai", just look at the surface and ignore the inside; It still depends on the integrity, systematicness and consistency of a strategy.

06

The Soul of Fundamental Research of Data Analysis

I have some experience in fundamental research, which can be used as a reference for investors who do fundamental research in the market.

Over the past five years, I have spent a lot of energy on data statistics. For example, Apple, including Zhuo Chuang’s data, analysts’ daily opinions, etc., we will pay attention to and carefully study and check. We track the inventory and delivery speed every week.

For example, if we want to make black varieties, then we must know the data of steel joint, steel valley and steel search.

At the same time, I will set up my own database and do their own data over the years, so as to make some comparisons and predictions for myself.

As long as you do more data, you will have a deeper understanding of a variety and an industry, and this understanding is our future wealth.

Wealth is the realization of cognition, and futures investment is actually making money from personal cognition.Maybe programmed trading may be different, but I think fundamental traders mainly rely on making cognitive money.

The best way to improve personal cognition is to study hard. When one’s knowledge accumulates to a certain extent, one can naturally discover real logic. As long as an investor’s cognition is improved to a certain extent, the investment efficiency will be improved.

I suggest you:Traders must make friends with data, establish their own database, and focus on factors such as output and inventory.

Investors should not only pay attention to the yield, inventory and consumption of varieties, but also learn to make charts themselves. The key is to improve their ability to analyze and find contradictions.

Although the data we need is cold on the surface, there are some opportunities for undercurrent; Investors need to spend time to analyze data, love data, build emotions with data, and find opportunities in love.

The data of some varieties over the years often imply certain laws or contradictions, and we need to catch it out.

Pay attention to the fundamentals, in addition to the above methods, you can usually participate in some research.

When I first made futures, I participated in the investigation of apples, glass, soda ash and sugar.

In those two years, I ran a lot and did a lot of research. However, I gradually realized that the research actually didn’t work very well. Because in that process, on the one hand, you can’t see a lot of things; On the other hand, many enterprises or industrial farmers, if you ask them something, people will actually take some subjective views.

Therefore, I think it is more objective to pay attention to the effect of the database. As long as you learn to analyze data, you can know what’s going on in the world without going out. So from the last two years, I basically stopped participating in the research, mainly doing data analysis and thinking for myself.

07

Facing the information science, identifying and grasping contradictions

No matter the stock market or the futures market, it is an effective market. In other words, when you see some information, the disk may have explained the changes brought about by this information.

If you only deal with this information every day, it will have little effect on the transaction, but it will make you indecisive because of the interweaving of information in the news every day.

In the market, most of the news is noise. As a fundamental player, you must remember that you can only trade any variety after seeing the biggest contradiction in fundamentals.

A while ago, I decided to invest in rebar trading, mainly because the market supply exceeds demand, while the demand is really sluggish, and there is a huge contradiction between supply and demand.

When an investor grasps the biggest contradiction in the market, he can and needs to see a lot of information in the market, but he must have the ability to distinguish, and don’t let the daily information change affect his trading decision.

If there is an inflection point in the market price and the fundamentals have indeed changed, then it is important to test a fundamental trader.

Investors should have the ability to grasp the detailed changes in fundamentals in a noisy market environment, which is determined by the trading skills and needs to be accumulated.

Because investment is a thing that needs to be accumulated, and the accumulation is thin, and haste makes waste.

08

Trading strategy method has no definite method to look at the market

My position cycle is long and short, and there is no fixed pattern.

There are not many trends in the market. Many times, the market fluctuates in shocks, and the holding time of a variety matches investors’ cognition of the variety.

If there is a big contradiction in the market, such as the coke and coking coal market in 2021, and there is a serious mismatch between supply and demand, then the holding period can be appropriately longer.

If the market only deals with short-term changes and prices often rise and fall, then this kind of trading is less involved.

If the market deals with major changes in fundamentals, the holding time will be relatively long.

Therefore,The length of holding positions mainly depends on whether the changing factors of fundamentals are large enough.

My entry account "Datian Aaron" has a maximum historical retracement of 35.84%, and the trading is still biased towards intraday trading. In fact, this is also a bad habit of mine, because I can’t help doing some transactions every day because of some time-sharing changes. In fact, most of these transactions are losing money, so this habit is not good, but the fundamental trading is not always holding on, which is two different things.

The varieties I trade cover almost all markets, including stock indexes, among which apples and palm oil account for the largest percentage.

My preference for variety selection is actually a reflection of my understanding of fundamentals. It can also be seen from the account of "Datian Aaron" that started in May 2022 that I trade more apples and palm oil.

I think, since that time, the market contradiction of these two varieties has been more prominent. Apple has indeed suffered a reduction in production this year, which is a relatively certain opportunity, so there was a previous wave of gains.

As for palm oil, when Indonesia accelerated its export after June 2022, we knew that it had gone through a big bull market for two or three years, and the price rose from more than 4,000 to around 12,000, which was already a very big increase, with the help of the Russian-Ukrainian war. However, after Indonesia accelerated its export, the fundamental situation changed completely, and we saw this.

In fact, palm oil is a variety that has fallen a lot and is smooth recently. If it is smooth, it is easy to hold it, including cotton and copper. There are obvious fundamental changes and it goes smoothly, which will be more friendly for the transaction. Therefore, palm oil and apples are the varieties that I traded more recently.

Followed by the black plate, there are also many transactions, including threads, iron ore, coking coal and coke. From May to now, these varieties are mainly traded.

09

Raise awareness. Iron ore earns more than one million yuan.

In the investment of iron ore, my profit reached more than 1.5 million yuan.

The investment result is the realization of personal cognition, and the fundamental trader earns the money of knowing the world.

The market of black varieties, starting from the monetization of shed reform in 2015, accelerated to "carbon neutral peak carbon dioxide emissions", and experienced a magnificent bull market, with all varieties increasing greatly.

In 2021, after the national "three red lines", we think that the market logic foundation of the black plate began to change. But it doesn’t mean that as soon as the fundamental situation changes, we have to trade immediately, and it sometimes takes time to change from quantitative to qualitative.

The real decline of the black system also began this year. Last year, it may be related to the global political and economic situation, especially the easing after the epidemic.

Starting from 2022, the United States will lead to contraction, and international varieties such as iron ore will be affected. Iron ore is a relatively volatile variety, which is related to both the black plate and the global macroeconomic environment. So it is a variety that I have made more in black.

Judging from the situation of supply and demand, everyone has already seen the reduction of steel production. In addition, the global economy is affected by the tightening caused by the interest rate increase in the United States. These factors are more obvious in iron ore. In addition, screw thread and "double coke" have also been done. These varieties have achieved good returns this year.

10

Laughing deeply understands the withdrawal of red dates with losses

My experience of losing money is very rich. Last year, about 60% of the capital interest in Xiaotian’s account was withdrawn.

The withdrawal of funds is a process that we will inevitably experience in the process of growing up, and it is an inevitable price to pay.

When the retracement happened, it seemed that we lost money, but in fact it helped us expose our own problems in the transaction and brought us an opportunity to reflect, correct and improve.

We have gradually enriched our experience in dealing with retracement, first, in fund management, and second, in grasping the fundamentals. This is a progressive process, and I hope I can slowly control the retreat after that.

Every big loss is a good accumulation of experience and a personal transformation. Every big loss experience is unforgettable, and every big loss variety is painful.

After each loss, I have a deeper understanding of a variety. In 2021, my big loss was on red dates. At that time, the production of red dates was reduced, and the price was predicted to rise.

For a variety like apple, we already know its ceiling price, but for a new variety like jujube, to be honest, there was still a lack of understanding of the price ceiling at that time, and the consumption power was overestimated.

Loss is not a bad thing; At least, for that variety, we will be more confident in the future, and the immediate loss is the cost that will not be lost in the future.

When trading red dates, my own position basis and reasons for opening positions were based on my own judgment at that time. The main basis was that I learned the information of jujube production reduction at the first time, which benefited from the information blessing of many friends and investment partners around me.

I know that after the production of red dates was reduced, I entered the market as soon as possible, although there were also exits on the way. Regulatory factors or various kinds of information from the market, such as less production than expected, will have a certain impact on intraday trading, but they have been taken down all the way, and the bottom warehouse has basically been there.

We thought there would be a higher price in the future, so we didn’t leave the position, but later there was a big retreat, basically like this.

When I fell, I was also carrying it at first. Until the New Year, I found that I really couldn’t keep up with my consumption. At that time, I decided to come out, but I had already retreated a lot of profits, so I made a wave and retreated a wave.

The biggest lesson we have learned is:The price of any variety in the transaction has a ceiling. This ceiling is essentially the point where high prices curb consumption.

Varieties such as red dates and apples are expensive to a certain extent, and people’s acceptance is poor. After doing it once, you will get a valuable experience, and you will know later.

In fact, my mood is rather depressed because the withdrawal of net worth is very large, and my psychological pressure is relatively great. But after you are out, you will let go. Adjust yourself as soon as possible to meet the next transaction. There will always be progress.

If you are small-minded, you can’t bear the fluctuation. When we finish the last transaction, we should invest in the next transaction with a brand-new mentality. Only by earnestly learning from the last experience and lessons can we do better and better.

11

It is common to study the stock market futures market carefully.

If we want to succeed in the stock and futures markets, we must study them thoroughly.

Fundamental trading, whether in stocks or futures, must be thoroughly studied.

For stocks, it is necessary to be able to calculate the profit of an enterprise in the future. The expectation of profit depends not only on your judgment of this industry, but also on your understanding of the profitability of the enterprise itself.

When we plan to invest in stocks, we can calculate how much money it will earn in the next year and what kind of valuation the market will give it, then we can figure out what price it will rise in the future. Although this calculation is not necessarily very reliable, at least you can know what its future trend should be like.

I used to do a lot of cyclical stocks, which have a certain connection with commodities, which is also a favorable help for me to transform into commodities later.

The price of goods will be reflected in the profits of listed companies; Similarly, the judgments on commodities and futures are basically the same.

We can draw some preliminary conclusions about stocks through calculation. For example, coal companies and mining companies can basically calculate their profits through the prices and costs of commodities. If you can give a correct valuation, you can probably figure out what price their share price will reach.

The same is true of futures. When you understand the relationship between supply and demand, you can know the ups and downs.

twelve

Reduce retracement management positions and strengthen self-discipline

Many people have ups and downs in futures investment, which is also a problem I encountered two years ago. That is to say, you can’t control the retreat, you can earn a lot when you earn, and you lose a lot when you retreat.

Futures trading sometimes embodies human nature. In this process, investors can only become mature day by day if they constantly experience and improve themselves.

Positions reflect the degree of greed and fear of investors. When you are greedy enough, you will often add a lot of positions, and many mistakes will occur during this period.

We should avoid the ups and downs in income and strive to reduce the retracement.First, to strengthen position management, we must have strict discipline.For example, ask yourself that the allocation of funds for a single variety should not exceed 20% or even 10% of the invested funds. As long as you can control yourself, then you can basically control the retreat.

The second is to improve personal cognition.Studying the fundamentals clearly can improve the winning rate.

If an investor not only improves the control of his own greed and fear, but also strengthens the cognition of the attributes of the goods themselves, it will certainly be of great help to control the withdrawal of funds and avoid ups and downs.

Investors can’t guarantee that the fundamental research they have done is correct, and the chance of making mistakes is inevitable.

When we place an order through fundamental research, if the market runs in the direction of research, then we should hold this order because you are right.

If there is a loss after two or three consecutive orders, it indicates that there may be something wrong with our research or the timing is wrong.Fundamental trading does not mean stubborn trading.

If the market trend does not match the research results, then we will start to question whether our research is correct. Is there anything else you haven’t noticed?

Sometimes my position will be higher, but this may be because there are many kinds of transactions. In fact, my position of a single variety will not exceed 20% now.

13

Short palm, seize the opportunity and make a big profit

I didn’t have many successful transactions in the past. Whether I made apples or red dates last year, although I made money, I made a big retreat.

I think it is a successful case to make palm oil in 2022.

At that time, when I saw Indonesia’s major turning point from banning the export of palm oil to accelerating the export one month later, I began to short palm oil, but unfortunately I didn’t get it from the beginning to the end.

Although the decline of palm oil exceeded my personal expectation, I basically entered the market at the highest point in this variety. Although I came out early, I didn’t retreat, so I was quite satisfied.

I was able to do this transaction better because:

First of all, thanks to our continuous tracking of its fundamental data.I have made detailed data on all oils and fats.

Secondly, seize the right opportunity to enter.At the moment when the contradiction between supply and demand occurred, I captured the information in time and was able to open the warehouse decisively.

Finally, the trading system and plan were strictly implemented.Instead of being a "frightened bird" in the market development, we have become a "snail that climbs up step by step".

This should be a successful case.

14

Hard work pays off.

Many fundamental traders are persistent and dedicated.Apart from the hobby of sports, I spend most of my life doing research except eating and sleeping.

I do data every day, and I buy a lot of data myself, such as Zhuo Chuang and Gang Lian. The time spent doing research is much longer than the time spent doing business. Except for trading, they are basically doing research.

With the accumulation of time, your cognition will continue to improve; You will become more and more familiar with all aspects of the variety. In the long run, you will have a qualitative change. When there are some fundamental changes in the varieties you are familiar with, it will be relatively easy and faster to grasp.

When each variety has a very clear sense and cognition in your mind, you are very skilled in it, and once the market changes, you will know how to judge.

Since 2017, I have accumulated nearly five years. Looking back now, it was relatively ignorant and naive.

Since 2019, I really accumulated the data and began to gradually understand various varieties.

15

Looking forward to the future, my heart is still climbing hard.

Many subjective traders around me have a lot of ups and downs.

When losing money, the mentality will not be too good.If an investor has a large position, the pressure can be imagined when he encounters losses. This is also related to the investor’s personality.

No matter what kind of investment you make, don’t be too heavy, which is the core of futures trading. It is necessary to grasp the fundamental situation and control human nature.

The result of the transaction matches the investor’s personality.A successful investor, after trading for several years, should be able to realize: what kind of person am I? What is my risk tolerance? Will I be anxious? Everyone’s personality is different, and the answers cannot be the same.

Experience can be replicated.If we have a knowledge of our own personality, then we will slowly explore a set of position management methods suitable for us. Everyone’s personality experience is different, and naturally it will not be repeated when it comes to trading, so everyone should optimize their own model, and it is more difficult to completely change it.

I hope I can do better in futures.

Many commodities have fallen for a long time this year, so you can pay attention to it. Varieties that have not fallen sharply, such as crude oil and soybean meal, can still be concerned.

Whether it is a subjective transaction or a programmed transaction, as long as it can make money continuously and steadily, it is a good way to trade for yourself.

Many excellent programmed trading teams or individuals have small retracement, well-controlled capital curve, stable income and excellent performance. The key is to find their own methods.

Therefore, I also agree with programmatic trading, but I will still stick to my fundamental trading method.

I am full of curiosity about this world, and I have a heart that I always want to explore and know. When I study a variety and understand its silent language and movement trend, I will have a great sense of accomplishment.This feeling, if I engage in programmatic trading, may not be available.

The ruler is short and the inch is long, and what suits you is the best.In the commodity market, behind the price changes of different varieties, there are many contradictions in economy, politics, macro-policy, culture, company management and supply and demand. If I can know more about the world, understand it more deeply, and reflect it with good results in my trading account, this is my greatest sense of accomplishment and my greatest happiness.

For traders, courage is definitely a double-edged sword. I think it’s better to be timid.

There are many ups and downs in the market, and not many people can make money for a long time and steadily.

A wave of big market can achieve a group of people; But after two years, you will find that many people have disappeared again. This is the normal state of investment.

Instead of ups and downs like that, it is better to take small steps steadily every day and not be too greedy. I prefer this mode.

16

Message exchange and learning in the competition have been greatly improved

Two years ago, my trading account retreated a lot, so I always wanted to find a good solution, and I wanted to communicate with experts and learn more from you.

I’ve tried many ways before, but the results are not ideal.Later, I found that it might be a good idea to participate in the competition, because during the competition, I can see the fund curves and net worth charts of some other excellent players, and the master’s practice will be of great enlightenment and help to me; Compared with our own capital curve, we will find many problems, understand many truths, correct many shortcomings and improve our requirements.Therefore, with this purpose in mind, I signed up for the big hand net competition.

There is a "seven-tailed fox" transaction analysis software in Dapan. com, which can conduct a comprehensive dialysis of its own fund accounts, which is better than some curve analysis of fund management we have done ourselves. So I like and cherish such an opportunity to learn and improve.

I hope that the large-scale mobile phone network can continue to be run, and the better it is! I also hope that more and more investors can join this platform of learning, communication and improvement, and I hope that everyone can make money!

Note:The content of this article is for reference only, not as investment advice. The market is risky and investment needs to be cautious..

200609 was compiled from an exclusive interview with the contestant "Da Tian Aaron"

[Disclaimer] This article only represents the views of the third party and does not represent the position of Hexun. Investors should operate accordingly, at their own risk.