Krypton’s revenue increased by 140% in the first half of the year, with a loss of 16 billion yuan in two and a half years and a valuation of nearly 100 billion yuan.

On November 9, 2023,Zeekr Intelligent Technology Holding Limited (hereinafter referred to as "") is in the United States.The Securities and Exchange Commission (SEC) publicly disclosed the prospectus, which is to be listed on the New York Stock Exchange with the stock code "ZK" and the underwriter as follows.、Merrill Lynch, CICC, BOC, HSBC, ICBC, Puyin, etc.

The prospectus shows that it is a fast-growing electric vehicle (BEV) technology company. Since its establishment, Krypton has been focusing on the innovation of BEV architecture, hardware, software and new technology applications.

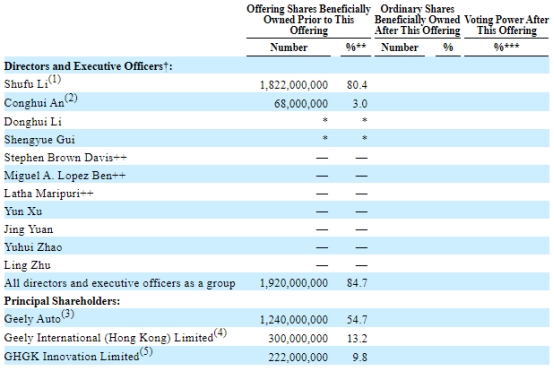

The prospectus shows that before this issuance,The proportion of shares held in extreme krypton is 54.7%; Geely International (Hong Kong) Co., Ltd. holds 13.2%; The shareholding ratio of GHGK Innovation Co., Ltd. is 9.8%. In the directors andLi Shufu holds 80.4% of the shares and An Conghui holds 3%.

Krypton intends to use the raised funds for the following purposes: about 45% will be used to develop more advanced BEV technology and expand the product portfolio; About 45% is used for sales and marketing, as well as expanding the company’s service and charging network; About 10% is used for general enterprise purposes, including working capital requirements, to support the company’s business operation and growth.

On August 25th this year, the website of China Securities Regulatory Commission published the Notice on the Overseas Issuance and Listing of Zeekr Intelligent Technology Holding Limited. According to the notice, the CSRC confirmed the filing information of overseas issuance and listing, and it plans to issue no more than 926,074,300 ordinary shares and list them on the New York Stock Exchange.

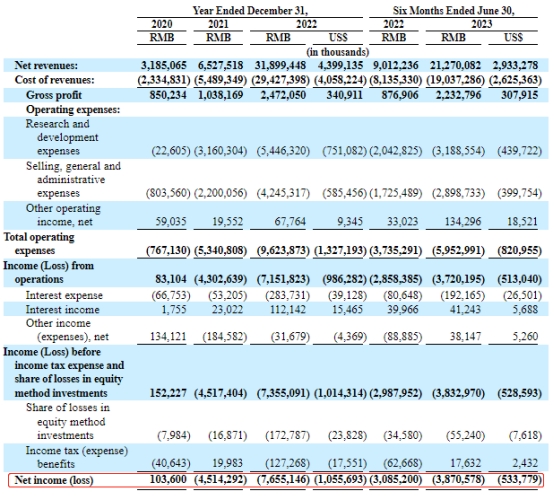

According to the prospectus, extreme krypton will be realized in 2020, 2021 and 2022 respectively.3.185 billion yuan, 6.528 billion yuan and 31.899 billion yuan;They are 104 million yuan,-4.514 billion yuan and-7.655 billion yuan respectively.

From January to June, 2023, Krypton realized an operating income of 21.27 billion yuan, compared with 9.012 billion yuan in the same period of last year, which was calculated to increase by 13.601% year-on-year. The net loss was 3.871 billion yuan, compared with 3.085 billion yuan in the same period last year.

In 2021, 2022 and January-June, 2023, the accumulated loss of Krypton was 16.04 billion yuan.

In addition, on February 13th this year, Krypton released the official news of "Krypton completed $750 million Series A financing" in official website. It is announced in the article that Krypton has completed the Series A financing of $750 million, with a post-investment valuation of $13 billion. This round of financing was conducted by Professor Amnon Shashua, founder and CEO of Autopilot Technology Company Mobileye.Yuexiu industryFive ecological partners, namely, Trade Fund and Quzhou Xin An Zhi Creation Fund, participated in the investment.

The proposed listing in the US is valued at nearly 100 billion yuan.

According to the prospectus, Krypton is a fast-growing BEV technology company. Since its establishment, Krypton has been focusing on the innovation of BEV architecture, hardware, software and new technology applications.

Krypton started its business as a department in October 2017. Under the leadership of co-founders Li Shufu, An Conghui, Li Donghui and Gui Shengyue, the company registered Krypton Intelligent Technology as an exempted limited liability company in March 2021 as a holding company of Krypton in accordance with the laws of Cayman Islands. Krypton said in the prospectus that the reason for seeking and listing separately is the different brand positioning of the company and the independence of operation, management and finance.

In April 2021, Extreme Krypton Innovation (currently a wholly-owned subsidiary of Extreme Krypton Intelligent Technology) was incorporated under the laws of the British Virgin Islands. During the same period, Krypton Technology (currently a wholly-owned subsidiary of Krypton Innovation) was incorporated under the laws of Hong Kong. In April 2021, Krypton announced the launch of the first BEV model ZEEKR 001, and the delivery began in October 2021.

According to the prospectus, before this issuance, Geely Automobile held 54.7% of the shares; Geely International (Hong Kong) Co., Ltd. holds 13.2%; The shareholding ratio of GHGK Innovation Co., Ltd. is 9.8%. Among the directors and senior executives, Li Shufu holds 80.4% of the shares and An Conghui holds 3%.

Krypton intends to use the raised funds for the following purposes: about 45% will be used to develop more advanced BEV technology and expand the product portfolio; About 45% is used for sales and marketing, as well as expanding the company’s service and charging network; About 10% is used for general enterprise purposes, including working capital requirements, to support the company’s business operation and growth.

On August 25th this year, the website of China Securities Regulatory Commission published the Notice on the Overseas Issuance and Listing of Zeekr Intelligent Technology Holding Limited. According to the notice, the CSRC confirmed the filing information of the overseas issuance and listing of Krypton, and Krypton plans to issue no more than 926,074,300 ordinary shares and list them on the new york Stock Exchange.

In addition, on February 13th this year, Krypton released the official news of "Krypton completed $750 million Series A financing" in official website. It is announced in the article that Krypton has completed the Series A financing of $750 million, with a post-investment valuation of $13 billion. This round of financing was invested by Professor Amnon Shashua, founder and CEO of Autopilot technology company Mobileye, and five ecological partners, namely Yuexiu Industrial Fund, Trading Fund and Quzhou Xin An Zhi Creation Fund.

Loss of 16 billion yuan in two and a half years

According to the prospectus, in 2020, 2021 and 2022, the company achieved operating income of 3.185 billion yuan, 6.528 billion yuan and 31.899 billion yuan respectively; The net profit was 104 million yuan,-4.514 billion yuan and-7.655 billion yuan respectively.

From January to June, 2023, Krypton realized an operating income of 21.27 billion yuan, compared with 9.012 billion yuan in the same period of last year, which was calculated to increase by 13.601% year-on-year. The net loss was 3.871 billion yuan, compared with 3.085 billion yuan in the same period last year.

In 2021, 2022 and January-June, 2023, the accumulated loss of Krypton was 16.04 billion yuan.

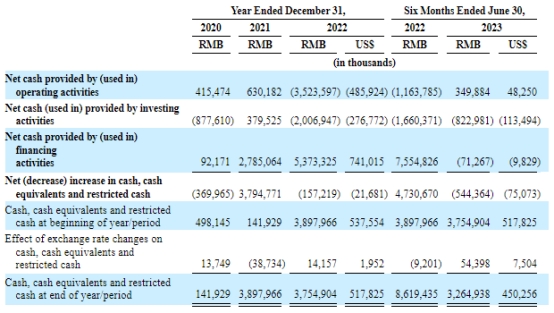

In 2020, 2021, 2022 and January-June of 2023, the net cash flow generated by Krypton’s business activities was 415 million yuan, 630 million yuan,-3.524 billion yuan and 350 million yuan respectively.

fine and soft hair or feathersFor two consecutive years.

From January to June in 2020, 2021, 2022 and 2023, extremely krypton hair26.7%, 15.9%, 7.7% and 10.5% respectively.

In 2021, 2022 and January-June 2023, the gross profit margin of automobile sales business was 1.8%, 4.7% and 12.3% respectively (the gross profit margin of automobile sales business in January-June 2022 was 4.7%).

Krypton said in the prospectus that the company’s gross profit margin decreased from 26.7% in 2020 to 15.9% in 2021, which was mainly due to the increase in income contribution from automobile sales. As the company just started to deliver ZEEKR 001 in October 2021, the gross profit margin of automobile sales was low. The gross profit margin of automobile sales in 2021 is 1.8%, andAnd other components in Mao Lijiao will decrease by 6% in 2020.

The gross profit margin of the company decreased from 15.9% in 2021 to 7.7% in 2022. The main reason for the decline is the substantial growth of the company’s automobile sales business, with a gross profit margin of 4.7% in 2022.

The gross profit margin of the company increased from 9.7% in the six months ended June 30, 2022 to 10.5% in the six months ended June 30, 2023. This growth is mainly attributed to the substantial growth of the company’s automobile sales business. In the six months to June 30, 2023, the gross profit margin of the automobile sales business was high, accounting for 12.3%.